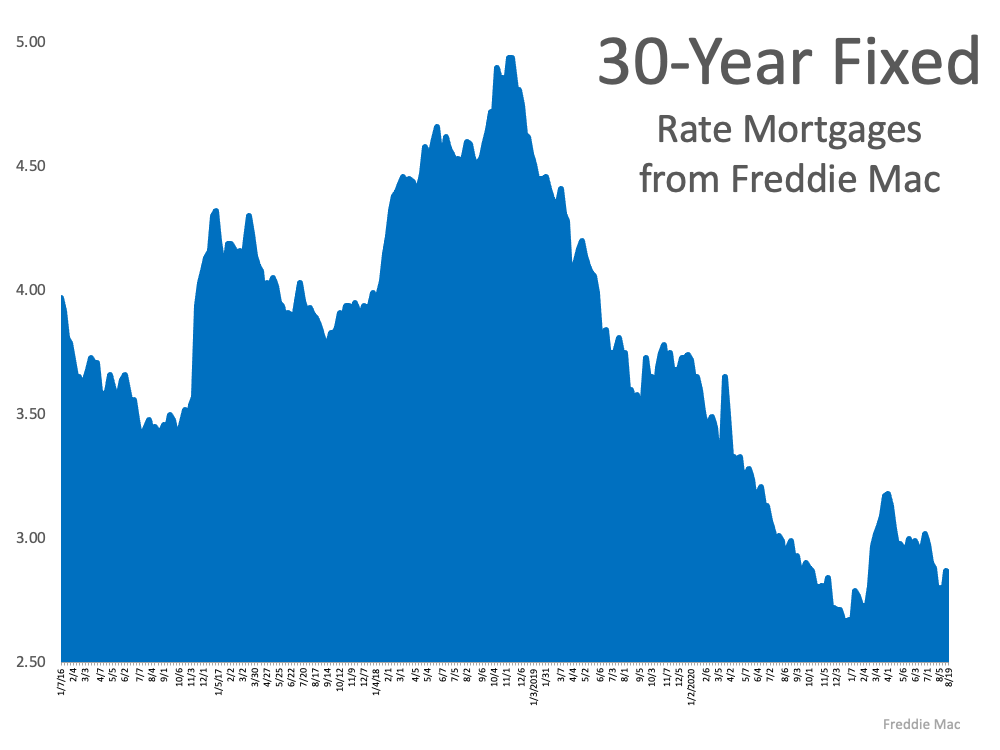

Mortgage rates are hovering near record lows, and that’s good news for today’s homebuyers. The graph below shows mortgage rates dating back to 2016 and where today falls by comparison.

Generally speaking, when rates are low, you can afford more home for your money. That’s why experts across the industry agree – today’s low rates present buyers with an incredible opportunity. Here’s what they have to say:

Generally speaking, when rates are low, you can afford more home for your money. That’s why experts across the industry agree – today’s low rates present buyers with an incredible opportunity. Here’s what they have to say:

Sam Khater, Chief Economist at Freddie Mac, points out the historic nature of today’s rates:

“As the economy works to get back to its pre-pandemic self, and the fight against COVID-19 variants unfolds, owners and buyers continue to benefit from some of the lowest mortgage rates of all-time.”

Mark Fleming, Chief Economist at First American, talks about how rates impact a buyer’s bottom line:

“Mortgage rates are generally the same across the country, so a decline in mortgage rates boosts affordability equally in each market.”

Danielle Hale, Chief Economist at realtor.com, also notes the significance of today’s low rates and urges buyers to carefully consider their timing:

“Those who haven’t yet taken advantage of low rates to buy a home or refinance still have the opportunity to do so this summer.”

Hale goes on to say that buyers who don’t act soon could see higher rates in the coming months, negatively impacting their purchasing power:

“We expect mortgage rates to fluctuate near historic lows through the summer before beginning to climb this fall.”

And while mortgage rates are still low today, the data from Freddie Mac indicates rates are fluctuating ever so slightly right now, as they moved up one week before inching slightly back down in their latest release. It’s important to keep in mind the influence rates have on your monthly mortgage payment.

Even small increases can have a big impact on what you pay each month. Trust the experts. Today’s rates give you opportunity and flexibility in what you can afford. Don’t wait on the sidelines and hope for a better rate to come along; the rates we’re seeing today are worth capitalizing on.

Bottom Line

Mortgage rates hover near record lows today, but experts forecast they’ll rise in the coming months. Waiting could prove costly when that happens. Let’s connect today to discuss today’s rates and determine if now’s the time for you to buy.

Interested in Buying, Selling, or Renting? Click HERE to speak with Josh today!!

___________________________________________________________________________________________________________________________________________________________

Frederick, Montgomery County, Middletown, Hagerstown, Boonsboro, Thurmont, Walkersville, Jefferson, Brunswick, Burkittsville, Rosemont, Point of Rocks, New Market, Mount Airy, Monrovia, Westminster, Damascus, Clarksburg, Gaithersburg, Germantown, Rockville, Bethesda, Silver Spring, Potomac, Kensington, Bowie, Laurel, Beltsville, Greenbelt, Glen Burnie, Baltimore, Baltimore County, Howard County, Takoma Park, Hyattsville, Owings Mills, Burtonsville, Olney, Montgomery Village, Ellicott City, Columbia, Severn, Townson, Sykesville, Derwood, Poolesville, Crofton, Odenton, Dundalk, Randallstown, Maryland Realtor, Maryland Real Estate Agent

***Article Courtesy of Keeping Current Matters, Inc***